After a surge in activity in February, the last seven days have seen a 32.32% decrease in non-fungible token sales. Out of the 19 different blockchains, Ethereum accounted for $148.56 million of the total $186.20 million in NFT transactions.

Recent Digital Collectible Purchases Dip Following February Surge

Throughout the last week, NFTs have racked up $186.20 million in sales with 760,857 buyers. Although the number of purchasers increased by 55.41% from the previous week, sales volume and NFT transactions dropped by 32.32% and 91% respectively. Ethereum is still the largest market leader, accounting for 79.78% of all NFT sales at $148.56 million. However, ETH-based NFTs experienced a 37.78% drop in sales compared to the week before. Meanwhile, Solana (SOL) rose 12.93% to $17 million and Polygon saw $6 million in sales, which is a 17.34% decrease from the previous week.

These were the top five collections by sales in the past seven days: all Ethereum-based. MG was the number one seller this week with total sales of just over $10 million, a 25.49% increase from the week before. Momoguro Holoself followed closely behind with $8.8 million in sales, and Sewer Pass earned $7.2 million. Bored Ape Yacht Club ($6.2M) and Otherdeed rounded out the top five at $5.35 million and $4.45 million respectively.

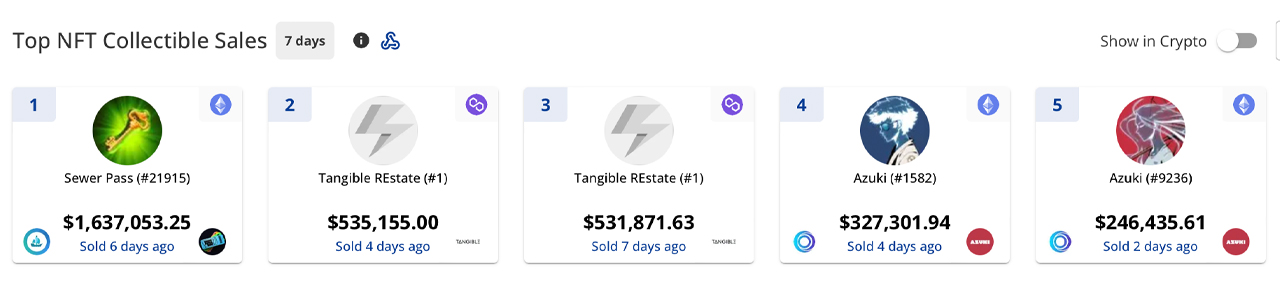

Interestingly, Ordinal inscriptions, or Bitcoin-based NFTs, were featured in this week’s market data via Emblem Vault. According to cryptoslam.io, Emblem Vault Version four (v4) contains a vast selection of Ordinal Inscriptions, Bitcoin Punks, and Counterparty blockchain trading cards. Emblem Vault v4 was the eighth biggest collection by sales this week, with a 287% increase compared to last week and total revenue of $4.25 million. The most expensive NFT of the week was Sewer Pass #21,915, which was sold six days prior for $1.63 million.

In terms of NFT market share, Blur was the clear leader this week at 79.7%. The NFT marketplace was the only one in the top five to experience an increase in sales volume, at 15.45%. OpenSea came in second with 10.02%, followed by SuperRare at 6.44%. Nifty Gateway, Sorare, and Bitski had less than 1% of the total NFT market share.

The non-fungible token (NFT) market has seen a slump in sales, as the market share has dropped by nearly a third in comparison to the week before. According to 30-day metrics, over $2 billion worth of NFTs were sold, with Blur capturing 74.5% of the market share, Opensea obtaining 22.4%, and X2Y2 taking 2.5%. The Rare Pepe marketplace Looksrare possessed 0.7% of the market share.

Last month saw a spike in February, but the market has since cooled down. Other noteworthy NFTs include Bitcoin Punks, Bored Ape Yacht Club, Cryptopunks, Decentralized, Digital Collectibles, ETH-based NFTs, MG Land, Momoguro Holoself, Ordinal inscriptions, Otherdeed, Polygon, Sewer Pass, Solana, Trading Cards, and virtual resources.

What is your opinion on the recent decline in NFT sales? Leave a comment with your thoughts and insights.