The Cryptocurrency market is still feeling the effects of Bitcoin’s drastic price drop on Saturday. After suffering from bearish trends, the majority of the digital asset market has been pulled down. But Investors are expecting the market to experience a further decline, though it may not be the end.

Possibility Of Another 5% Loss By End Of The Month

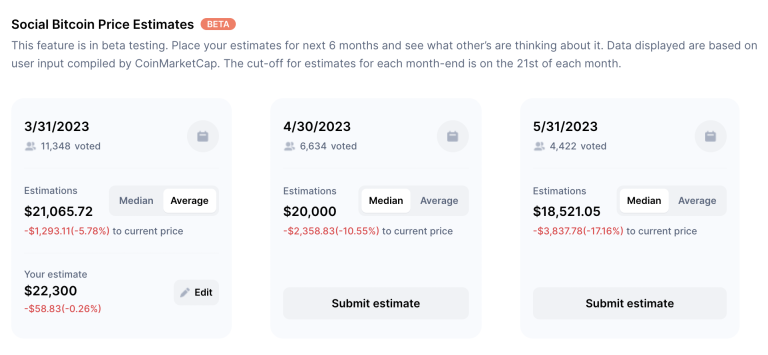

The month of March has seen its share of bad news for the crypto market. This sentiment is echoed in the Coinmarketcap’s Price Estimates feature, which gathers up votes from the community regarding the expected direction of a digital asset’s price. The results are not looking too good for Bitcoin as it is currently being viewed as a bearish investment.

The 11,000+ votes that were collected in the month of March have shown a decrease in expected prices. At the end of March, the median price prediction was $21,084, which is a 5.67% decrease from the current price. If this prediction were to become true, the market would lose an additional $1,200, pushing Bitcoin further into bear territory.

Crypto Community still very bearish| Source: Coinmarketcap

For the next few months, the bearish outlook for prices remained the same. With expectations for the digital asset continuing to drop each month after March, the median price aim came to $18,313 by the end of June. This would mean that the market would be down by $3,000, a greater loss than expected.

Bulls Searching For Momentum To Re-Gain

Despite the majority of the community being bearish, there is still hope for bulls. Over the last few days, Bitcoin has managed to recover from its losses and is now trading around $20,000. Investors are now hoping that the digital asset will break the $21,000 resistance level to regain momentum, potentially changing the community’s expectations and pushing the market back up.

The current outlook for Bitcoin prices isn’t too promising, with the majority of investors expecting further losses in coming months. According to a recent survey, more than 4,400 participants predicted that BTC could drop as low as $18,521 by the end of May.

But what does investor sentiment tell us? According to the Crypto Fear & Greed Index, the market is still in a neutral state, but that could change quickly in response to a sudden price crash. The good news is that neutral sentiment can be swayed in either direction, so a swift surge in prices could be just around the corner.

The chart below shows BTC’s recent movements, with a $1200 loss within an hour.