Central Banks are showing persistent interest in gold as the year 2023 progresses, as reported by The World Gold Council. The report highlights that during the month of January, central banks across the globe added a total of 31 tonnes of the precious metal to their reserves. Turkey was the largest contributor, adding 23 tonnes to its holdings, followed by the People’s Bank of China with 15 tonnes.

Central Banks Maintain Gold Purchases Despite Potential Challenges In 2023

At the time of writing, gold prices are currently trading at $1,857.50 per troy ounce, a 1.12% increase in the last 24 hours. Prices have been declining since late January, when they breached $1,950 against the U.S. dollar. The World Gold Council (WGC) released a report on March 2nd, titled “No Dry January for Central Bank Gold Buying”, which explains that in January 2023, the central banks maintained the demand that had been registered at the end of the previous year.

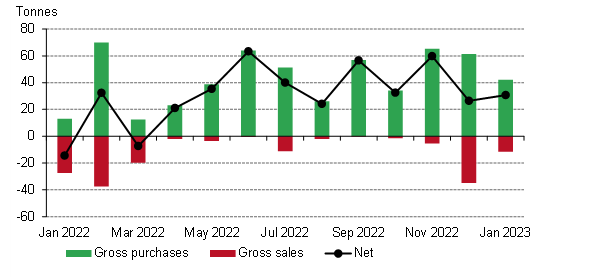

The report’s author, Krishan Gopaul, stated that much of the buying came from Turkey, China and Kazakhstan. “Central banks collectively added a net 31 tonnes (t) to global gold reserves (+16% m-o-m) in January”, he wrote. “This was also comfortably within the 20-60t range of reported purchases which has been in place over the last 10 consecutive months of net buying.”

In total, 44 tonnes of gold were purchased and sold by central banks during the month of January. One of the central banks sold 12 tonnes to offset its existing reserves. The largest buyer was the Central Bank of Türkiye (Turkey), which purchased 23 tonnes of gold during the month. According to the country’s records, the total amount of gold held by the bank now stands at 565 tonnes.

Coming in second in terms of gold purchases was the People’s Bank of China, which bought 15 tonnes during the month. The National Bank of Kazakhstan also increased its gold reserves by 4 tonnes, which brings its total holding to 356 tonnes. According to the report, the data was gathered from the International Monetary Fund (IMF). This data may be revised in future WGC monthly reports.

The European Central Bank added two tonnes of gold to its reserves, while the Central Bank of the Republic of Croatia sold 12 tonnes. The selling of gold was due to Croatia’s recent joining of the Eurozone, which required that the country transfer its reserve assets to the ECB.

The World Gold Council (WGC) has released a report that predicts that central banks will continue to purchase gold in the year 2023. The WGC states that, although the rate of buying may not be as high as the records set in 2022, the demand for gold by central banks is still expected to remain strong.

According to the report, the central bank of Uzbekistan now holds 384 tons of gold. Other countries such as China, Kazakhstan, and Turkey have also increased their gold holdings to record levels. The WGC also notes that the European Central Bank and the International Monetary Fund have both made significant purchases of the precious metal.

Gold prices have been on an upward trend since the start of 2021, and the WGC’s report suggests that this trend is likely to continue in the months and years ahead. Krishan Gopaul, the author of the report, believes that central bank demand for gold will remain strong, but may struggle to reach the levels seen in 2022.

It remains to be seen just how central banks will continue to shape gold demand in the future. What is certain, however, is that the demand for gold will remain a key factor in the global economy.