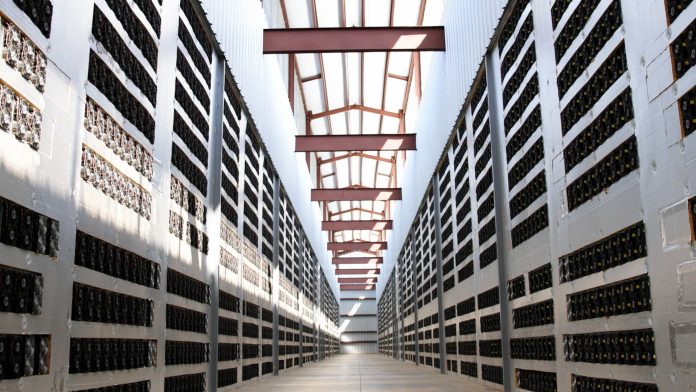

Core Scientific’s 104-megawatt Cryptocurrency Mining Data Center in Marble, North Carolina

Carey McKelvey

Core Scientific, one of the biggest digital asset miners in the United States, has requested for Chapter 11 bankruptcy defense in Texas on early Wednesday. This follows a year of diminishing crypto prices and increased energy costs.

Core Scientific is involved in the proof-of-work mining of cryptocurrencies like Bitcoin. This process requires the use of specialized, energy-intensive computers to crunch mathematical equations in order to confirm transactions while also generating new tokens. This requires specialized gear and technical know-how.

The company’s market capitalization dropped to $78 million by the close of trading on Tuesday. This is a dramatic plunge from its July 2021 peak of $4.3 billion, when the company was taken public through a special purpose acquisition vehicle. In the last year, their stock has gone down by more than 98%.

According to a source familiar with Core’s financial situation, the firm is still creating positive cash flows, but this is not adequate to settle its equipment lease debt. The company will not be liquidated but will be able to continue its operations until it reaches a deal with senior bondholders, who possess the majority of Core’s debt.

Core had previously warned in October that common shareholders could possibly face “a full loss of their investment,” but this may be changed if the wider industry experiences a revival. The agreement with the convertible note holders ensures that common shareholders might not be completely wiped out if Bitcoin trading conditions improve.

The Bitcoin token, which Core mostly produces, has dropped from an all-time high of more than $69,000 in November 2021 to roughly $16,800. Reduced values, increased competition among miners, and rising energy prices have all contributed to the loss of value. As a result, profit margins have been squeezed.

The Austin, Texas-based miner, with data centers in North Dakota, North Carolina, Georgia, and Kentucky, stated in October that “operational performance and liquidity have been severely affected by the continued decline in the price of Bitcoin, the increase in electricity costs,” as well as “the increase in the global Bitcoin network hash rate.”

Core was a customer of the crypto lending firm Celsius, which declared bankruptcy in July and was able to pay off its debts during the bankruptcy proceedings. Core’s failure is another example of the contagion effect which swept through the crypto sector in the course of 2021.

Core is one of the largest providers and hosts of blockchain infrastructure and hosting services, and one of the largest digital asset miners in the world. The battle for survival of North American miners is not unique.

Compute North, which provides infrastructure and hosting services to crypto miners, submitted for Chapter 11 bankruptcy in September, and another miner, Marathon Digital Holdings, disclosed an exposure of $80 million to Compute North. Meanwhile, the vertically integrated cryptominer Greenidge Generation reported net losses of more than $100 million in the 2nd quarter of 2021 and announced plans to pause expansion into Texas. And Argo’s announcement of a plan to raise $27 million from a “strategic investor” was not successful and their shares dropped by 60% on Oct. 31.