The last difficulty adjustment for the Bitcoin network saw a 9.95% increase, leading to an all-time high difficulty level. Despite this, the 30-day average hashrate has remained relatively stable at 305 exahash per second (EH/s). Data shows that it is currently at 308 EH/s over the last 2,016 blocks. The next difficulty adjustment is scheduled for March 10 and is expected to go up as the block times have risen from the 10-minute average of 8 minutes 30 seconds to 9 mins and 41 seconds per block.

Difficulty Increase Predicted as Hashrate Stays Above Value

The power of the Bitcoin network has held strong even after the 9.95% rise in difficulty that occurred on February 24, 2023, at block height 778,176. As of Sunday, March 5, the difficulty is an astonishing 43.05 trillion hashes, with the cost of mining remaining higher than the spot value. The hashrate has stayed within the 300 EH/s range for the past several weeks.

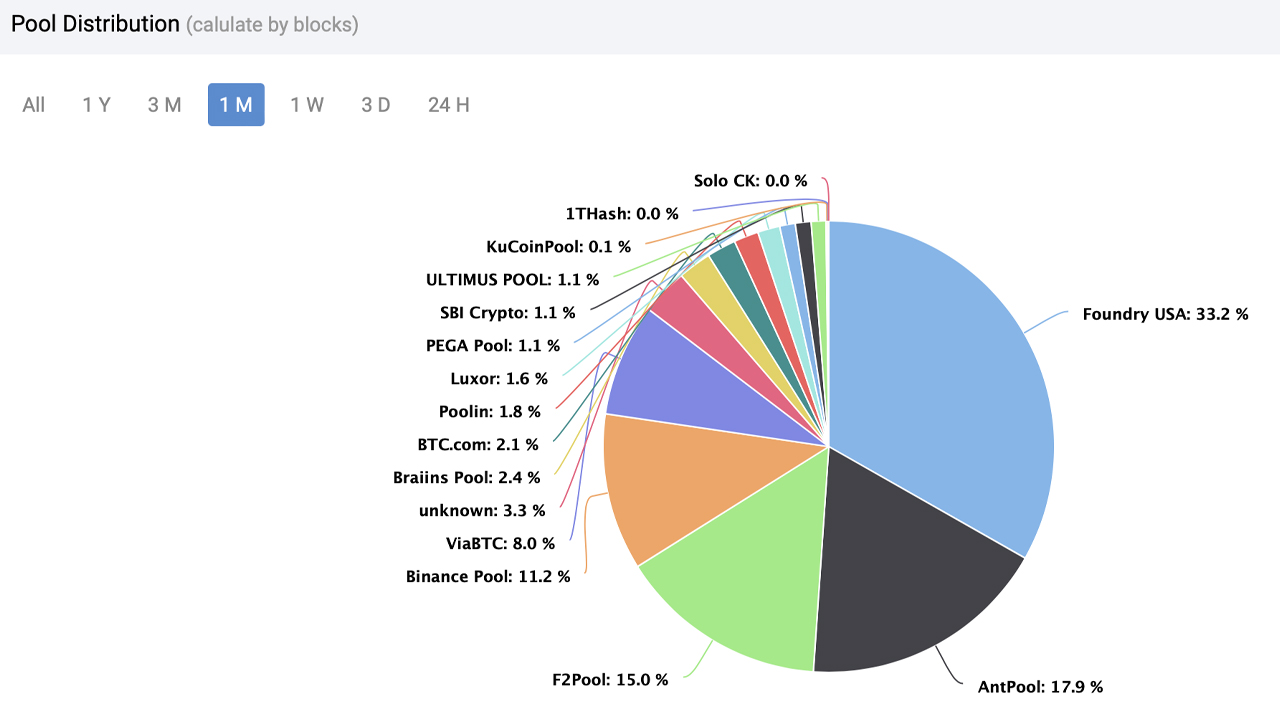

At the time of writing, there are still over 60,000 blocks left to mine before the upcoming halving. Over the past 30 days, 4,557 blocks have been mined, with Foundry USA discovering 1,514 of them. Foundry’s global hashrate is at 34.44%, amounting to 113.45 EH/s over the last 24 hours. Of the 151 blocks that were mined, Foundry produced 52, with their three-day stats showing 163 blocks.

Looking at the 30-day, 3-day, and 24-hour statistical data reveals that Antpool was the second-largest mining pool during these periods. Of the 4,557 blocks mined since February 5, 2023, Antpool discovered 815, which accounts for 17.88% of the global hashrate in the last month. Foundry Antpool F2 was next (14.99%), followed by Binance Pool (11.24%) and Viabtc (8.03%).

Mining operations have had to deal with the lower BTC spot price that has dropped by more than 8% in the last 2 weeks. Despite the fees for sending transactions increasing to 3.5% of the block reward value as of February 16th, the hashrate of the Bitcoin network has gone up by 9.95%, indicating that miners are still turning a profit. The hashrate has stayed consistent since the start of the year.

Miners are preparing for another projected difficulty increase as the hashrate rises despite market uncertainty. According to data, network fees are 2.1% of the block reward at present, with a block reward of 1.5% just four days prior. Despite the associated costs of mining, many mining pools are still contributing to the growing global hashrate. Some mining operations may be deterred by the high cost of production in relation to the spot market price and the continuous increase in difficulty.

What do you think the future holds for bitcoin miners in the face of market instability and the expected rise in difficulty? Share your thoughts in the comments section below.