Key Takeaways

- Bitcoin volatility is the highest it has been since July 2022

- Liquidity is severely diminished, leading to increased volatility and more dramatic price movements

- $4.2 billion of options are set to expire on Friday, with the bulls likely to benefit from the recent rally up to $28,000

Recently, I wrote an article looking at how the connection between Bitcoin and the stock market, particularly tech companies, had strengthened. This was due to the banking issues that arose after Silicon Valley Bank suddenly collapsed.

Not only has correlation increased, but market swings have also become more extreme – the volatility is at its highest since July 2022, when Celsius’s sudden disappearance sparked panic.

What is causing the volatility?

The increased volatility is not surprising given the large amount of liquidity in the markets. We wrote a piece about this earlier in the week, showing that 45% of stablecoins had been taken off exchanges over the past four months, with the balance at its lowest level since October 2021.

This explains the recent surge in Bitcoin’s pricing. With less liquidity in the market, changes are more significant, and Bitcoin has climbed to $28,000, up 68% this year.

This thin liquidity makes the upside more pronounced, but also increases the downside risk.

It is a worrying sign for an asset that is already known for its extreme volatility.

Derivatives boosting the volatility

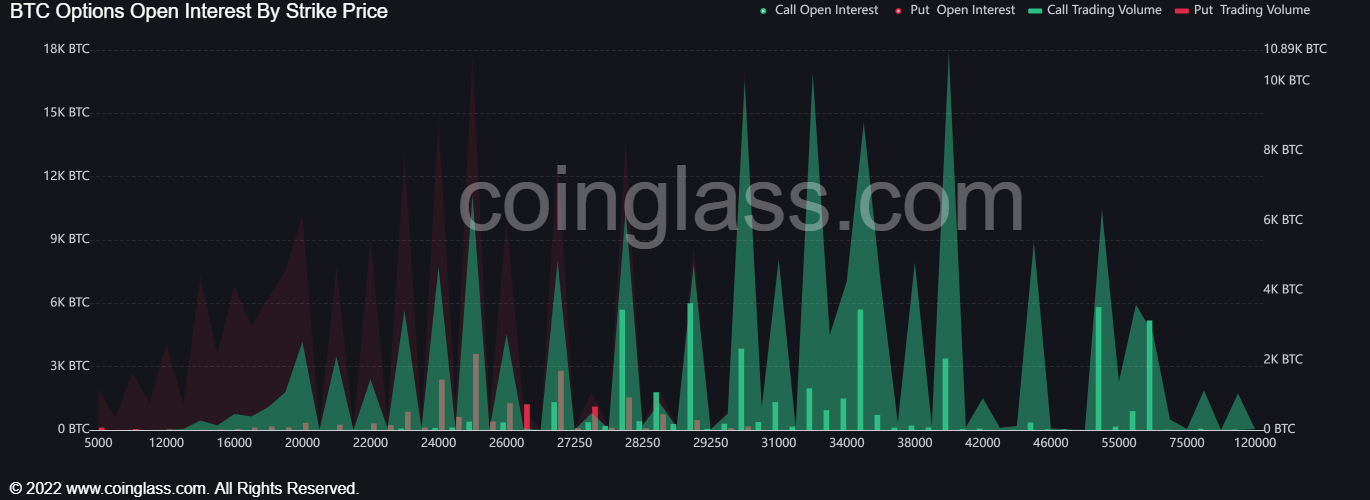

Another factor is the soaring amount of derivatives open interest, as illustrated by the chart below from Coinglass. It shows that options open interest is at its highest point since November 2021.

As we write this on March 31st, a stunning $4.2 billion of Bitcoin options will expire. The chart also shows the option strike prices – with a call/put ratio of 2.09 and Bitcoin trading close to $28,000, many traders are set to make a profit.

Breaking down the numbers, there are 97,300 call options expiring at a strike price of $28,000 or less, compared to 24,500 put options. That’s a total of over $2 billion for calls.

For the next price level up, the majority are call options. Between $28,000 and $32,000 there are 48,000 call options versus 400 put options, with a $1.4 billion split in favour of calls.

After a year of bears dominating, the bulls may finally get to benefit.

The Bitcoin spot holdings are also showing encouraging news. In December, most Bitcoins were in positions that were losing money when compared to the price at which they last moved.

Today, however, 74% of the supply is in the green using the same metric.

With interest rate policy expectations softening, Bitcoin has been given the opportunity to soar. But with low liquidity and high volatility comes risk, though when it comes to Bitcoin, risk is nothing new.