On December 13, 2022, The USA Commodity Futures Trading Commission (CFTC) has presented a legal challenge against Sam Bankman-Fried (SBF), FTX Trading LTD. Alameda Research. The CFTC claims that FTX customers have deposits. “during the relevant period,” These include fiat currencies and cryptos. “taken by Alameda for its own use.”

US Commodity Futures Trading Commission: ‘FTX And Alameda Commingled, Misused And Misappropriated Funds From FTX Trading Clients’ From Day One

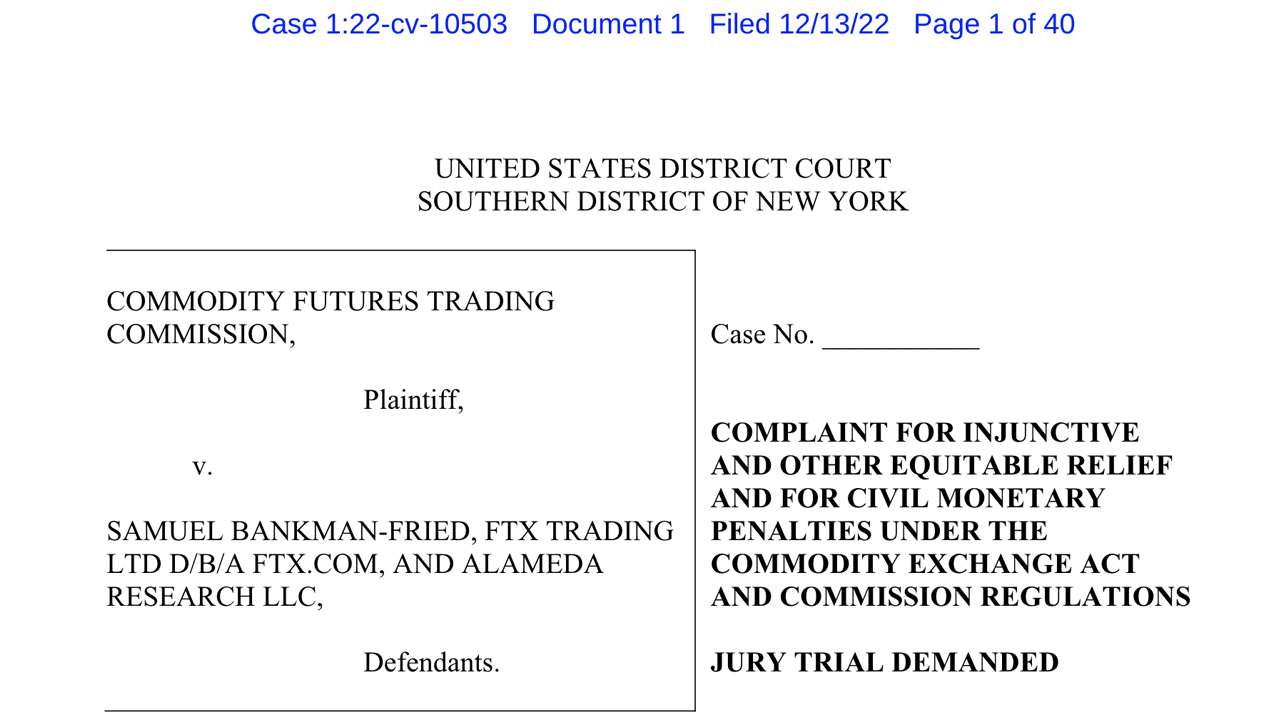

The US Commodity Futures Trading Commission (CFTC has filed a lawsuitCase SBF and its subsidiaries FTX (1.22-cv-10503) Alameda Research. The You can sue for damages. “at the guidance of Bankman-Fried, FTX executives designed features in FTX’s underlying code that allowed Alameda to maintain an essentially endless line of credit in FTX.”

The CFTC claims that SBF and its inner circle are being used to mislead the public. “took hundreds of millions of dollars” In loans beginning at Alameda The funds were used for purchasing property in the Bahamas, “political contributions, and for other unauthorized uses.”

The CFTC Court filing insists:

Through This conduct, and the conduct described in this document later, are both unacceptable. [the] The defendants committed a breach Section 6(c),(1) of the Commodity Exchange Act.

The A US commodity regulator is seeking “civil monetary penalties and ancillary remedies.” AlsoLike the SEC accusations, the CFTC also wants SBF to cease trading. The CFTC believes it is competent to regulate SBF. Bankman-Fried is a US citizen, who has lived in many parts of the world. SBF and its subsidiaries have also done business in the US since a “relevant period,” The CFTC court document states. For example, Alameda Research It is possible to Delaware Limited liability company with limited liability registered in the United States.

“FTX Enterprise failed to comply with corporate formalities, including failure to separate funds, operations, resources, and personnel, or proper documentation of transfers between companies or funds and other resources,” The CFTC complainant alleges. “The entities regularly shared offices, systems, accounts and communication channels. Based on information and belief, assets flowed freely between the FTX Enterprise entities, often without effective documentation or tracking,” The court document was added.