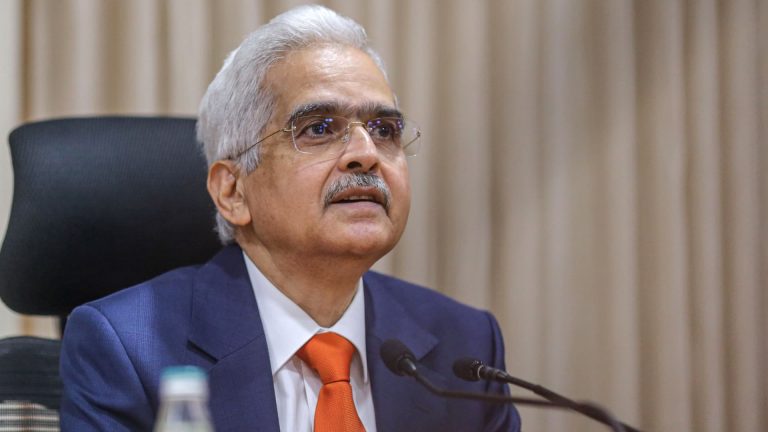

Shaktikanta Das, head of India’s Reserve Bank (RBI), has asked for private digital currencies to be prohibited.

Dhiraj Singh | Mayor Bloomberg | fake images

The governor of the RBI has stated that cryptocurrencies may cause the next financial crisis. The warning was issued by the Indian central bank on Wednesday.

“Cryptocurrencies present huge inherent risks to our macroeconomic and financial stability,” said Shaktikanta Das, Governor of the Reserve Bank of India. As an example, he cited the recent FTX crash.

Das’ main concern is that digital currencies are not backed by anything and are merely speculative. He believes that they should be outlawed.

“That [private crypto trading] is 100 percent speculative activity, and I would still hold the view that it should be banned… because if it’s allowed to grow, if you try to regulate and allow it to grow, mark my words, the next financial crisis will come from private cryptocurrencies,” Das stated.

Private digital currencies, such as Bitcoin, are referred to as cryptocurrencies. Bitcoins.

The RBI has also been testing a digital version of the Indian rupee. The digital rupee pilot program was launched on December 1 in select cities. Users can use mobile wallets and apps to make digital rupee transactions.

The digital rupee is a form of central bank digital currency (CBDC). Many central banks around the world are looking into digital currencies.

Das stated that CBDCs could be used to facilitate quicker international money transfers and reduce the logistics involved in printing tickets.

China is the most advanced when it comes to CBDCs. Beijing has been testing the digital yuan in real-world scenarios since late 2020.

After the value of cryptocurrencies plummeted by $1.3 trillion and the highly publicized crash of FTX, the need for cryptocurrency regulation was brought to the forefront.

China has effectively banned cryptocurrency trading.

The Indian government is currently working on cryptocurrency legislation that will prohibit certain activities related to digital currencies and create a legal framework that will enable the RBI to issue digital currency.

Although cryptocurrencies were previously thought to be a minor asset, central banks have increasingly voiced their concerns about the potential macroeconomic effects of cryptocurrencies, especially if they remain unregulated.

Jon Cunliffe, Deputy Governor of the Bank of England, said in July that cryptocurrencies may not be “integrated enough” into the financial system to be an “immediate systemic risk.” He believes that the line between traditional finance and cryptocurrencies will become increasingly blurred.

The US Treasury Department also stated in October that “crypto asset activities could pose risks to the stability of the US financial system.” The department stressed the importance of regulation.