As 2022 draws to a close, Bitcoin Crypto winter proponents are wondering if it’s really over. The The current bear market is the longest bottom since the Bitcoin bear market of 2013-2015. Analysts It is also important to note that most of the lower-level technical indicators used to predict Bitcoin prices cannot predict when the bottom will come.

Rainbows S2F: The List of technical indicators that can’t anticipate the bottom Bitcoin

Bitcoin Supporters celebrated the endurance of one month of the longest bear market for Bitcoin since 2013-2015. The The longest period of recession was 2013-2015, when the Bitcoin bear ran. HoweverToday’s contraction for the present crypto economy is going to surpass the crypto shrinkage in 2013.

In In addition, longer lower phase, Bitcoin.com News It It was reported that several technical indicators could not predict Bitcoin’s future price in US dollars 144 days prior. One The stock-to-flow (S2F) model was one of the most horrendous pricing blunders this year. It It was censured by Ethereum Advocate Anthony Sassano ETH co-founders Vitalik Buterin last June.

“We need more pain before hitting rock bottom”

My We’ve You are a beloved friend.

– a top 3 exchange collapse

– Top There are 2 VCs in the vicinity.

– 2 top 10 coins with an mcap of $60B+ go to zero

– loan market wiped out

– Bitcoin 80% Discount on ATH

– Alts Below 90-99% AthWhat else do you want?

—KALEO (@CryptoKaleo) December 22, 2022

With Many Cryptocurrency advocates keep writing forum posts, despite technical indicators failing to be ‘better’. social media threads On The blurred background Bitcoin For For Take, for example. December 27 Twitter Account Crypto Noob tweeted: “Bitcoin Currently Trade in the Oversold Area Which It It is the place where the bottom used to be historically. Do Do You believe that BTC is at its bottom?

Questions Posts Such forums and social media platforms include a large number of crypto-focused forums. Facebook Twitter. On RedditThe The r/cryptocurrency forum has a post which highlights the failure of lower technical indicators. The Post’s author clarifies that analysts don’t understand the problem. “have no idea” This Time “IS different.”

The The author “u/Beyonderr” Post This article explains why 8 technical indicators were not reliable for Bitcoin traders this year. Bitcoin Market. For The Weekly RSI (for instance)Relative Strength IndexThe symbol () was supposed denote Bitcoin’s bottom or oversold levels. Beyonderr “ This year, however, it was not the case.

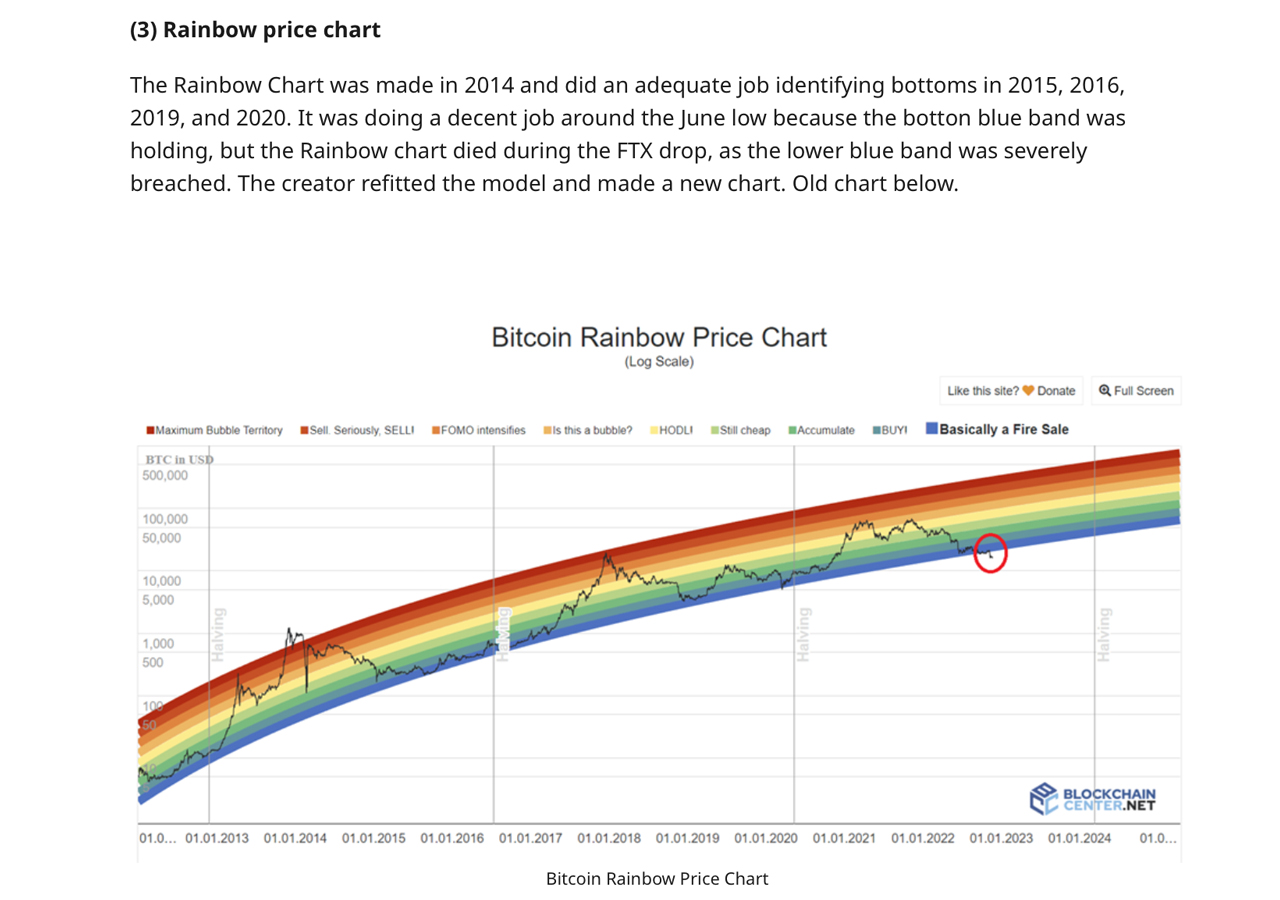

Other Unreliable Technical signals Beyonderr pointed out include the monthly MACD (moving average of convergence/divergence), the Rainbow Price chart, 200-week-moving mean, 100-week-moving median X 20,-week-moving mean, the indicator to the Pi Cycle Hash Indicator Tapes and the average percentage reduction of the maximum for a single cycle.

In addition, Beyonderr also mentioned and mocked S2F’s pricing model “Meme bonus” indicator. “Worst indicator of them all, Plan B’s horrible Stock-to-flow model. Add it to the failed stack,” Beyonderr wrote. On r/cryptocurrency, there were also suggestions that there might be four indicators that indicate bottom “might be in,” according to Beyonderr.

Indicators Cited By Beyonderr Use signals like “time to market,” “Puell Multiple,” “Mayer Multiple,” “MVRV Z-score.” Meanwhile, many people use social media platforms such as Twitter to express their opinion that the bottom is very nearly reached, yet most technical signals have shown unreliable deviations.

What Do you recall the flawed technical indicators that failed to anticipate Bitcoin’s bottom? What We would love to hear your opinions on the topic. Leave comments below.

Image Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This This This article is intended for informational purposes only. It This It is not an offer to sell, buy or solicit. It This website does not endorse any products, companies, or services. Bitcoin.com is not a provider of advice regarding investment, tax, legal, or accounting matters. Neither The The author and company are not responsible for any loss or damage that might be caused by or alleged to have been caused by any content, goods or services in this article.