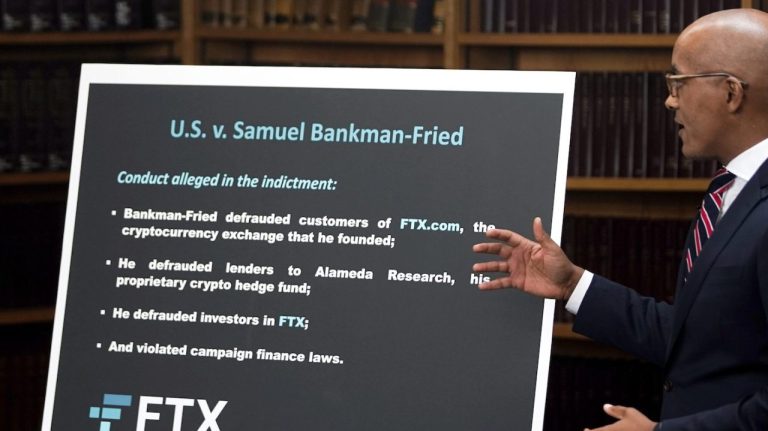

The latest crypto exchange collapses have highlighted the dangers of the digital currency system, and the current approach is not sustainable.

Cryptocurrencies provide a fascinating glimpse of the future of finance, with the technology to engage consumers like never before.

Stock market crashes can cause huge uncertainty, and these platforms have seen the risks of unregulated and unsupervised services in finance.

So how can we have the best of both? Utilize the innovation while keeping consumers safe.

The answer is twofold: 1) Establish a strong regulatory framework to govern digital currencies and related activities. 2) Permit consumer-friendly institutions such as credit unions to provide digital asset services.

The crypto exchange failures show that the hazard is not in the technology itself, but in the misrepresentation of potential clients over every aspect from bookings to insurance status.

This has been enabled as these companies exploit loopholes in order to gain the benefits of regulated institutions without giving any protections.

Federal regulators and the government must ensure these companies can no longer act in this manner. Regulations must stay up to date with these technological advancements.

Credit unions must obey a variety of rules and regulations at both the federal and state levels. They are designed to protect customers and their data, as well as their funds, through responsible financial institutions.

When it comes down to it, would you rather trust an offshore crypto exchange or your local credit union, which you have accounts and a car loan with?

Credit union members have a high degree of faith in their financial institution and their ability to protect their best interests, according to CUNA’s 2022 National Voter Survey.

Credit unions were originally the defenders of customers. We should make our members our top priority because they are the ones we must answer to.

We are a great ally for those interested in joining the crypto space. We are not aiming to make money nor meet shareholder demands. Our aim is simply to offer the services that our members need in a secure, affordable way.

Research from the White House reveals that 16 percent of Americans are involved in cryptocurrency. CUNA data has shown that 39 percent of credit union members are engaged with crypto. 59 percent of credit union members are between 18-34.

These are consumers who are eager to explore the possibilities of digital currencies and rely on their credit union for all their financial requirements. It is a natural combination.

A sound cryptocurrency regulatory system would help rebuild trust and give credit unions the freedom to keep up with the latest payments technology.

Credit unions would have more leeway to provide digital asset wallet service, which would permit consumers to explore this new technology securely.

At the end of the day, this industry cannot continue as it is. Customers should be our first concern as credit unions provide a dependable entry point to this market.

Jim Nussle Is the President/CEO of National Association This is Credit Unions.