The current crypto-market runs are often likened to the bull-run of 2017. Though we have limited data available to compare the circumstances, it raises the question, what will happen in 2021?

1. Dwindling Bitcoin Supply

As Bitcoin turns twelve on January 3rd, some experts have warned about its decreasing circulation. PayPal, which recently joined the US market, has allegedly purchased 70% of all freshly minted coins.

This can affect the liquidity of the asset, depending on how these large investors use their coins. PayPal might be keeping a large amount of Bitcoin to meet the demands of its users in the future.

Bigger companies may be tempted to buy all the Bitcoin they can, in order to store it in the long-term. A decrease in supply is likely to increase demand, consequently pushing prices higher in 2021.

2. An Altseason

2020 has been referred to as the ‘year of DeFi’ due to the success of many projects in the space. Some investors anticipate that the year will end with a record-breaking performance.

Chart of DeFi TVL (Total Value Locked) for 2020

In this time of sideways activity, investors may be attracted to investing in altcoins for diversification purposes. Undervalued coins could see huge spikes due to a sudden influx of liquidity, providing great profits for investors and developers alike.

Altseasons are a major part of the cryptocurrency industry’s growth. In 2021, we may expect to see a lot of altcoins ‘riding the wave’ of Bitcoin’s success. But to identify which coins will explode and which ones will stagnate, Nik Patel’s blog is a great source of information.

3. Bitcoin Boom after Halving

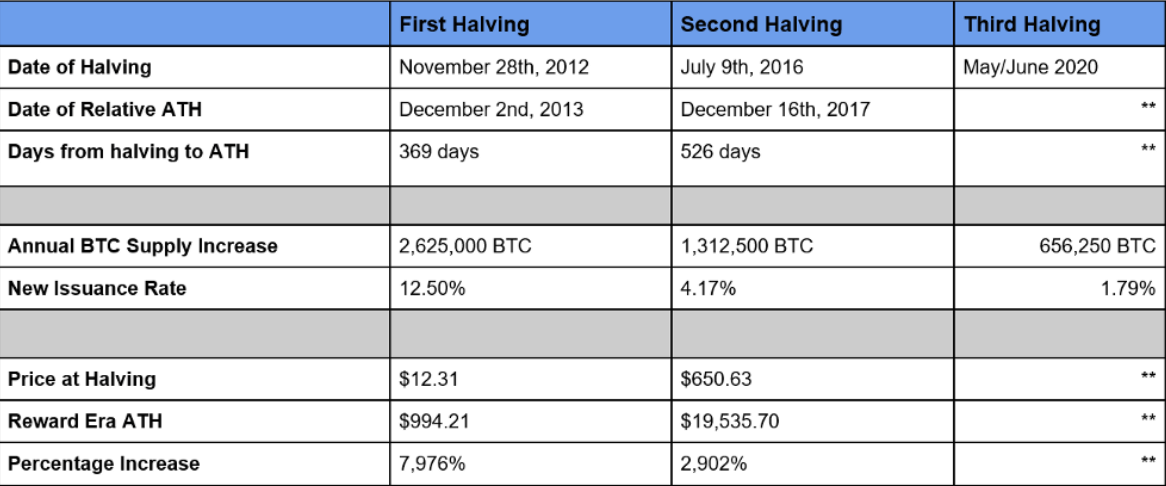

In May, Bitcoin underwent its third halving reducing the block reward for miners. Although it is difficult to predict the immediate aftermath of these events, it is useful to look at the all-time highs (ATH) to be aware of.

As we can see in the table, the new highs usually come in December of the year following the halving. Investors may be tempted to hoard assets between now and December 2021 to maximize their profits.

It is also possible that we could spend 2021 building higher lows and higher highs in order to hit the $50,000 mark that many analysts believe can be reached by the end of the year.

Image taken from the Fitzner Blockchain blog on Medium

4. More Cryptospace for Financial Professionals

Recently, there has been an increase in institutional investors entering the market. Square, Greyscale and PayPal have all announced the integration of cryptocurrency into their respective platforms.

This trend is likely to continue into the new year, with the most recent example being Ray Dalio. The billionaire did a Reddit AMA (Ask Me Anything) on the subject of Bitcoin.

Dalio wrote: I believe digital currencies, including Bitcoin, have been a viable alternative to gold over the past ten years. They offer interesting asset options, similar to gold, but with limited supply. Therefore, they could be used to diversify, as an alternative to gold, or other wealth assets.

This is a stark contrast to his previous comments on Bitcoin, indicating a more positive outlook for the asset in 2021. This, plus the news that other billionaires and hedge-fund managers are also accumulating an interest in the asset, is expected to bring more people to the market.

All-in-all, we can expect to see an exciting year in 2021, with greater adoption and understanding of the advantages that cryptocurrencies can bring to people’s day-to-day lives.