A recent report has compared the scalability of decentralized finance (defi) to traditional finance, and found that despite market headwinds, the potential of defi is much greater. The total value of assets locked in defi protocols declined from $180 billion to around $50 billion, but certain parts of the market remain bullish.

Decline in Total Value Locked

According to the Year-end Report from Hashkey Capital, defi has the capacity to be more scalable than traditional finance. The report suggested that defi protocols have the capability to survive tough market conditions, such as the Terra Luna/UST collapse.

In the Defi Ecosystem Landscape Report, Hashkey Capital noted that the decrease in total value locked (TVL) was due to the general market environment. Lower cryptocurrency prices, as well as lower trading activity on decentralized exchanges, both contributed to the decline in assets under management.

The TVL hit a peak of $180 billion in December 2021, but this dropped to just over $50 billion by October 2022. However, the report suggested that certain parts of the defi market were still displaying bullish tendencies.

Growth of Defi Slower Than 2021

The report commented on the degree of adoption of defi, noting that growth in 2022 (31%) was slower than 2021 (545%). The report also cited the increase in wallets, which rose to more than 5 million.

2022 is a year where projects are focused on building and improving products, rather than spending resources on marketing. The user interface and experience of users are being redesigned, with defi protocols now easier to use than a mobile banking app.

The report observed that the majority of support for defi came from venture capital, with $14 billion invested in 725 crypto projects (many of them defi) in Q1 2022.

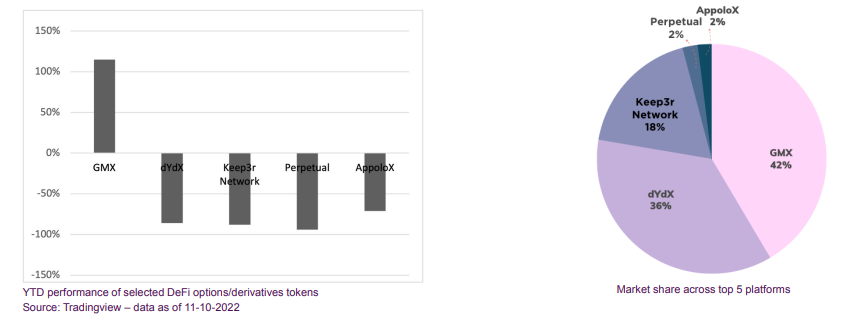

The report highlighted the possible trigger of the upcoming defi spring, pointing to the options and derivatives sector. Platforms such as GMX saw a substantial growth in users and TVL, with its TVL rising from $108 million to $480 million by the end of October 2022. Meanwhile, Dydx saw its token price drop by 90% over 12 months, but still had over $50 million in revenue and over 1,000 weekly active users.

What are your thoughts on this story? Let us know in the comments below.