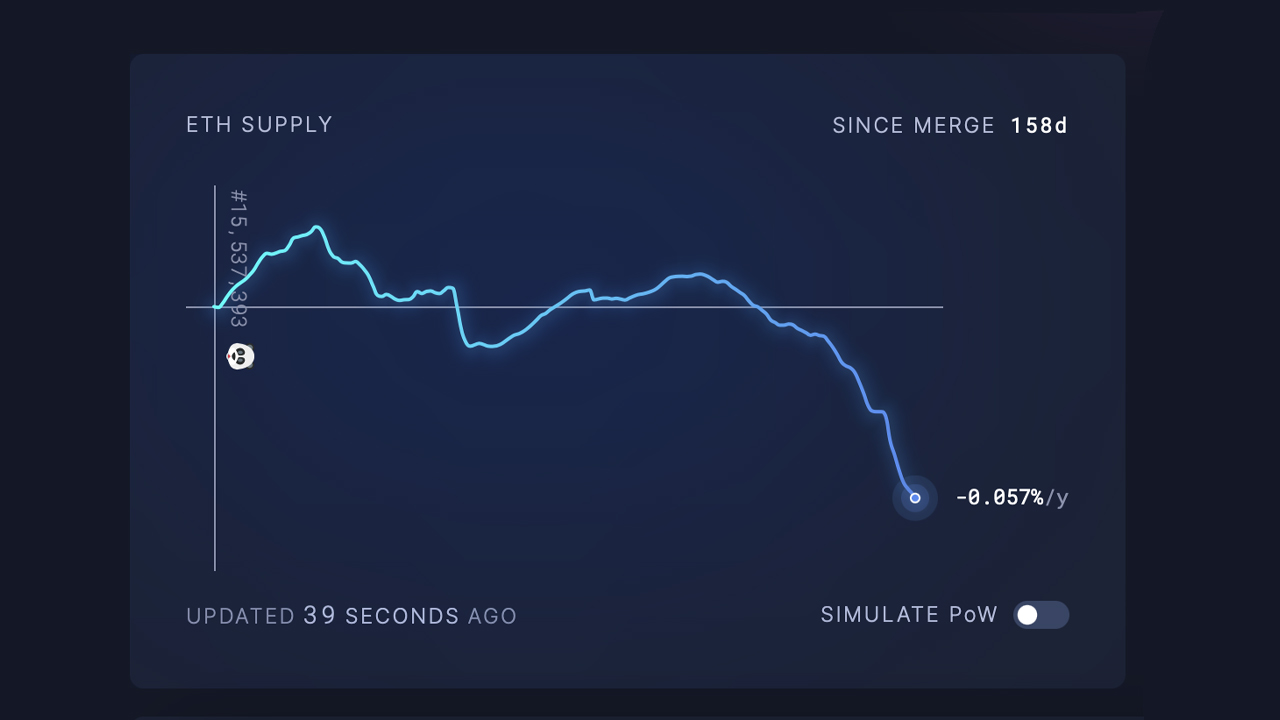

After Ethereum’s transition from proof of work (PoW) to proof-of stake (PoS), its annual issuance rate fell to a less-than-favorable 0.057% based on data collected 158 days after the Merge.

Negative Annual Ethereum Emission and Ether Unlocked in March Could Alter Steadiness

The evaluation website ultrasound.cash shows that the Ethereum community is in a state of deflation. According to metrics gathered following implementation of EIP-1559 during the London hard fork, more than 1.023 million ether has been taken out of circulation each year. The current annual issuance rate of 0.057% is not advantageous. It stands at -29.797 ether.

It is demonstrated that more ethereum is currently kept out of circulation than is being issued. Had Ethereum used PoW, the issuance rate would have increased by approximately 3.49% annually. As of October 10, 2020 at 10:30 (ET), the estimated number of ETH tokens in circulation was 120,491,331. At that same time, 16,763,815ether were locked within the Beacon Chain Contract. When the Shanghai upgrade occurs in March, these funds could be released from their locked states, potentially causing a lot of activity. Locked Ether accounts for $28.61 trillion of the second largest cryptocurrency’s 205.77 billion market value, or 13.91% circulating supply and market value.

Statistics from ultrasound.cash show that Ethereum’s current annual issuance rewards stand at 4.1%, with the consumption rate for non-participants being 1.8% per year.

What do you think the long-term holds? As Ethereum’s community transitions to proof-of stake and roll out updates, the issuance rate as well as the circulating supply will continue to rise. Share your thoughts in the comment section below.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.info/sk/join?ref=W0BCQMF1

Your article helped me a lot, is there any more related content? Thanks!