Bitcoin’s record-breaking rally has led to a surge in profits for crypto miners, with daily mining revenues reaching an all-time high of $78 million. This comes as no surprise, as the price of bitcoin has also hit record highs, with analysts predicting even higher levels in the near future.

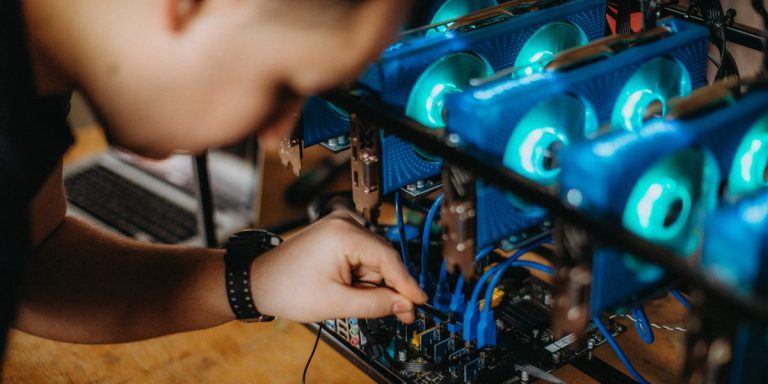

The rise in mining revenues can also be attributed to the anticipation of the Bitcoin halving event in April, as miners are investing in new equipment to improve their operations. This event, which happens every four years, reduces the amount awarded to successful miners each year. In preparation, thirteen firms are expected to invest $1 billion on specialized equipment and computers by 2023.

However, this investment is necessary as the halving cycle can often lead to a decrease in profits, potentially causing firms to shut down outdated rigs. The last halving in May 2020 saw a significant reduction in miner rewards, forcing many to shut down unprofitable operations.

But for bitcoin investors, the halving event is expected to ignite a price rally. In the past, prices have risen by 5% in the 30 days leading up to the event, with even bigger increases of 13% and 27% seen in previous halvings. This could also result in a decrease in bitcoin supply, as higher token prices mean miners may need to sell less to achieve the same profit.

Analysts predict that the price of bitcoin could reach $100,000 by 2024, driven by the increase in ETFs and other favorable factors such as regulatory changes and loosening monetary policies. With Wall Street showing more interest in bitcoin, the future looks bright for crypto and its miners.