Individuals from the United States, South Korea and the Russian Federation have been revealed to be the most frequent users of centralized exchanges this year, according to a new study. After the dramatic crash of FTX, one of the largest platforms of its kind in history, tighter regulations and fewer users has made this finding possible.

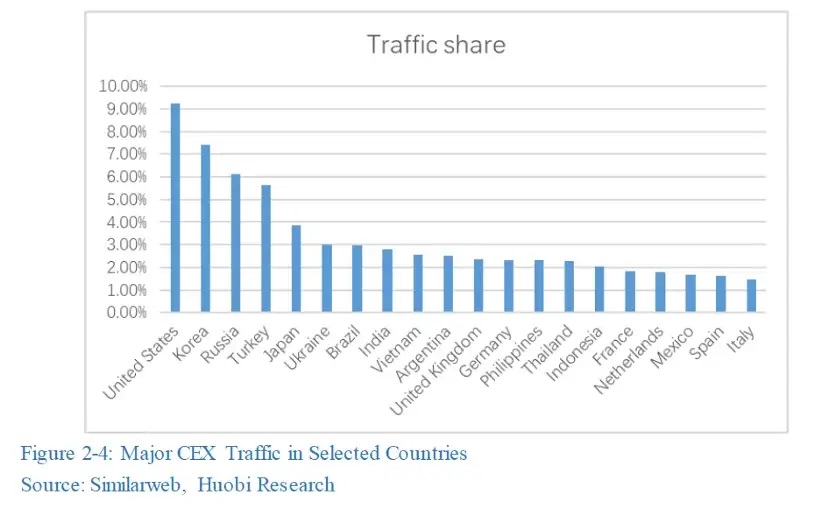

United States Leads in CEX Users, Followed by Turkey and Japan in Traffic

In 2022-2023 annual reports, the US, South Korea and Russia account for 22% of all visits to cryptocurrency central exchanges (CEXs). This estimation is based on data from the top 100 CEXs about active users, trading volumes, trading depth and reliability, according to the “Global Crypto Industry Overview and Trends” produced by Huobi Research.

The US holds the largest share with more than 9%, followed by South Korea with 7.4%, Russia with 6.1% and Turkey and Japan with 5.6%. The drivers vary in each case – high unemployment and high house prices making young people insecure in the US, western sanctions for Russians, hyperinflation and the economy in Turkey.

The authors of the report emphasize that “centralized exchanges are vital in the cryptocurrency market, as they are usually easy to use and many crypto newbies start with them.” It is important to note that most users and liquidity on the crypto market are aggregated onto centralized exchanges.

The findings were made following the bankruptcy filings of FTX, one of the largest CEXs. Called by researchers “the incident of the year since entering the current bear market”, it took place on November 11 due to liquidity issues, as well as the collapse of Terra, the bankruptcy of 3AC.

Further research shows that the market for CEX in 2022 was smaller than the previous year. The number of unique visitors dropped by 24%, with “the continued gloomy market condition and depreciating assets” being the reason, according to the report. At the same time, the rate of new user growth decreased to 25 million from 194 millions in 2021.

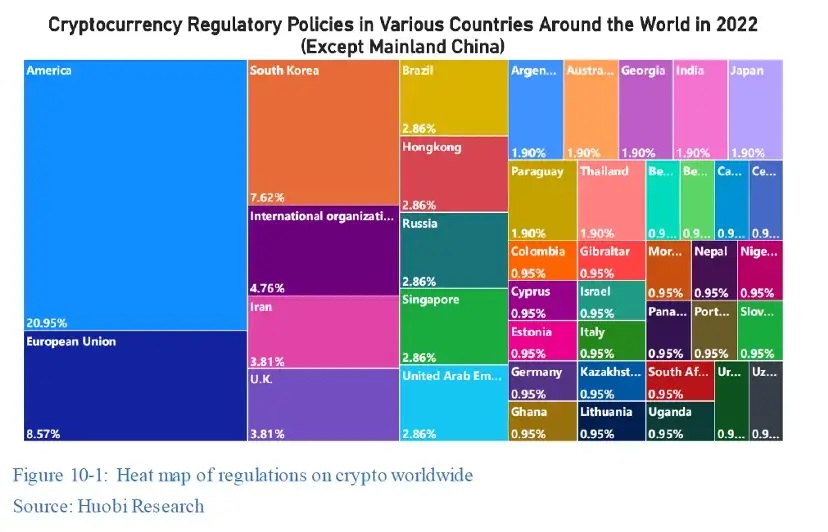

Regulations on Central Exchanges Tightened in Key Jurisdictions Worldwide

Huobi Research also states that the regulations on centralized cryptocurrency trading platforms are becoming more stringent globally following the FTX bankruptcy, including on-chain activities. CEXs could be required to show proof of funds, or keep a certain amount of funds in reserve, or may even be forced by regulators.

This year, US President Biden signed an executive order to ensure the responsible development of digital assets, the EU passed its Markets in Crypto Assets (MiCA) legislation, and Russia has been working to expand its legal structure for cryptocurrencies, with eight related regulations being passed in South Korea.

Decentralized finance (defi) has been