- Retail investors have been vigorously buying up Bitcoin, according to data from Glassnode.

- The 30-day net position change of those with less than 10 BTC has only been higher on 116 occasions.

- Bitfinex reported that the number of Bitcoin addresses with a non-zero balance had risen to 45.388 million.

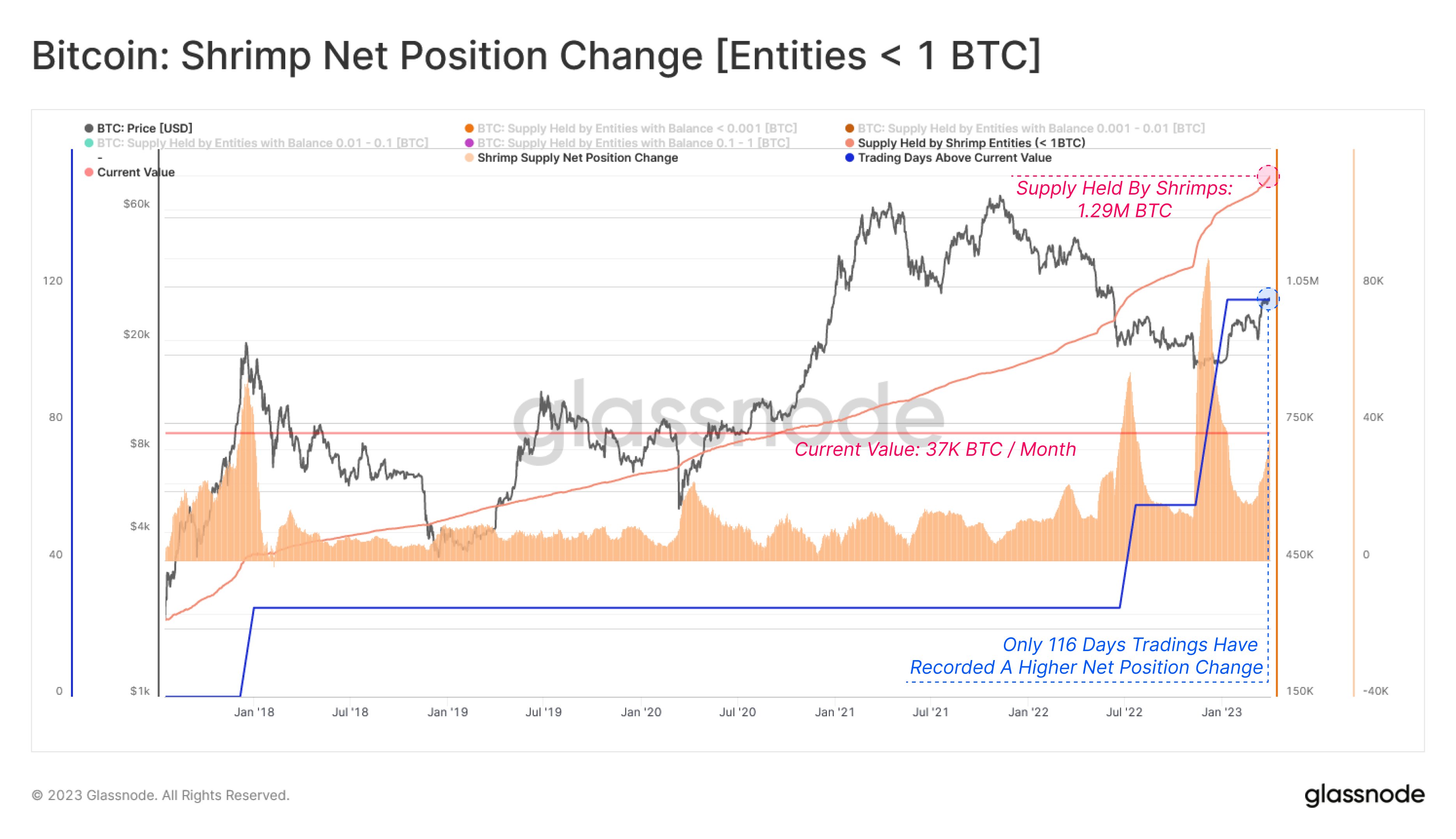

Smaller investors have been actively accumulating Bitcoin, according to market data from on-chain provider Glassnode.

The firm evaluated the 30-day net position change of those who own less than 10 BTC, which Glassnode calls “shrimps”. It concluded that the current rate of accumulation has only been higher on 116 other trading days.

1.29 million BTC held by shrimps with less than 1 BTC

Glassnode’s data shows that the total supply held by this group is 1.29 million BTC. The “shrimp” class of investors who own less than 1 BTC have a 30-day change of 37 BTC/month.

“We can assess the 30d change to the supply held by the Shrimp class (< 1 BTC) to evaluate the intensity of retail participation. Currently, only 116 days have recorded a larger 30d change, suggesting retail participants are aggressively accumulating,” Glassnode tweeted.

Chart showing Bitcoin Shrimps net position change. Source: Glassnode

This comes as Bitcoin’s price has been hovering around $30,000, leading to bullish sentiment in the market. Analysts’ projections of the coin retesting $30,000 have been strengthening demand among small investors.

With #Bitcoin price action continuing to climb towards the cycle baseline ($30K), market participants have responded by aggressively accumulating coins.

This underscores a similarity in structure between the current cycle and 2018-19 cycle.

📊 https://t.co/b1E5fiLnpQ pic.twitter.com/h1vq22ldqj

— glassnode (@glassnode) March 31, 2023

On Monday, crypto exchange Bitfinex released its Bitfiniex Alpha report, which we highlighted today. In the report, analysts pointed to growing demand for BTC among small investors, with those addresses with non-zero balances hitting a record 45.388 at the end of last month.