Riot Platforms, formerly known as Riot Blockchain, has seen its stock price surge to the highest levels since April 2022, even as Bitcoin remains in a deep consolidation phase. The shares have jumped by more than 430% from the lowest level last year.

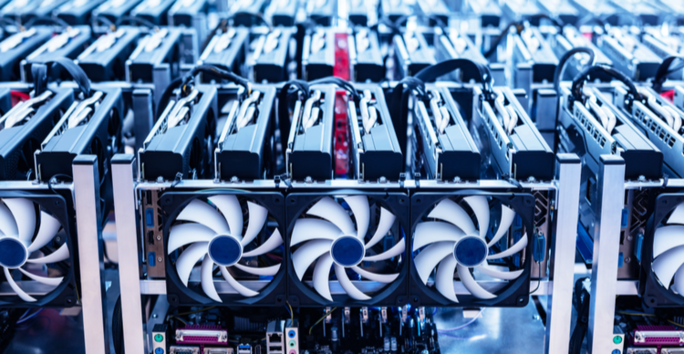

The stock has risen for two main reasons. Firstly, analysts are still bullish on Bitcoin. For example, Standard Chartered sees BTC hitting $120,000 by 2024, while billionaire investor Tim Draper expects the price to surpass $325k in the coming years. Secondly, investors believe that Riot will increase its mining capacity in the coming months. The company recently acquired 33k Bitcoin miners for $163 million.

Let’s look at the daily chart. The RIOT share price has been in a strong bullish trend in the past few months, rising above the key resistance level at $14.37 and the 25-day and 50-day moving averages. The Average Directional Index (ADX) has also moved above 20, indicating that the rally will continue.

Therefore, while a pullback is possible, investors are targeting the resistance level at $20. A move above this level could see the RIOT share price surge to $23.60 (March 22 high).