London, UK, 8th September 2023 — Chainwire — One Trading, the crypto asset exchange formerly operating under the Bitpanda Pro brand, today announced its new product, Instant Trade.

The €30M-funded venture has taken a step forward in diversifying its offering and establishing itself as a trusted provider for both retail and institutional investors in Europe. With prominent investors including Peter Thiel’s Valar Ventures, MiddleGame Ventures, Speedinvest, Keyrock and Wintermute Ventures, One Trading is quickly gaining attention.

Led by former JP Morgan executive Josh Barraclough, the company looks to address the lack of regulated venues in Europe by providing sophisticated crypto products, including derivatives and spot trading, to both institutions and retail customers.

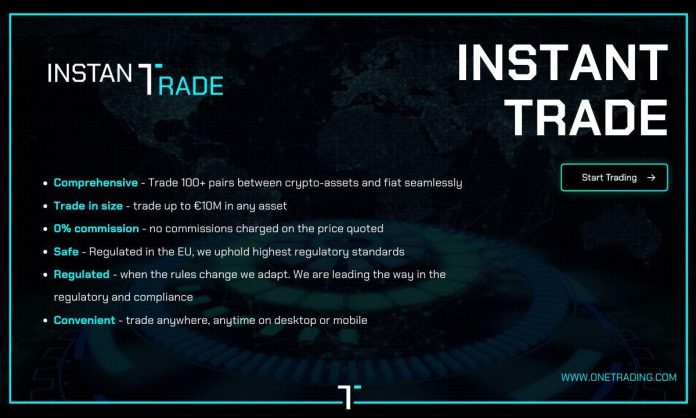

Instant Trade is the latest product being launched. Josh had this to say: “We’re thrilled to bring our OTC product, typically reserved for institutional clients, to all customer types. Our customers can now trade 100+ pairs between crypto-assets and fiat seamlessly with great fiat on and off ramps at the click of a button, and commission-free trading. Most brokers charge a dealing fee when customers buy or sell assets, however, Instant Trade will have 0% commission, meaning there is no additional dealing fee charged on Instant Trade aside from the market spread applied.”

The UI is simple and easy to use, and customers can trade up to ten million euros in one trade. With a VASP license, people can be assured that it is a safe and regulated service. To compare prices, users can test out Instant Trade on One Trading’s website.

“Our aim is to make crypto trading safe and accessible for all, bridge the gap, and provide an institutional-grade platform for all customer types. We have been rolling out a rebrand and a number of big infrastructure changes. Our exchange is one of the fastest and most scalable, with order create/cancel times of less than 250 microseconds. We will have low fees, deep books for retail, and liquidity protections. We will then start listing more products with appropriate controls and vetting as we move into derivatives. Above all, we want a regulated, institutional-grade platform where people feel safe to trade.” Josh Barraclough, CEO, One Trading.

One Trading intends to operate as a MiFID Trading Venue, which will augment its existing VASP license, and would allow its platform to offer capital-efficient spot and derivative products for all customer types. It also offers a higher level of protection for customers who will be vetted through stringent anti-money laundering (AML) and Know-your-customer (KYC) procedures as well as client appropriateness checks. The full-scale MiFID license will also allow One Trading to list financial instruments – removing the debate over whether a DLT asset is a token or a security – and will permit new products to be designed from the ground up with appropriate vetting, transparency and customer protection in mind.

One Trading’s platform also offers access to a high-touch and secure OTC trading service, enabling high-net-worth individuals and institutions access to a wide range of digital assets, with competitive fees, and deep pools of liquidity.

The One Trading team is based and headquartered in Europe with offices across Amsterdam, London, Milan, and Vienna. It is regulated in the EU and has built its product and venue to meet the needs of European customers. It’s mission is to bridge the gap between crypto and traditional asset trading with a single regulated trading platform for all customer types and all products.

For more information, customers can visit www.onetrading.com and learn more via One Trading’s social channels.

For press inquiries, contact: Marketing Contact, Andy Keelaghan, One Trading, [email protected]