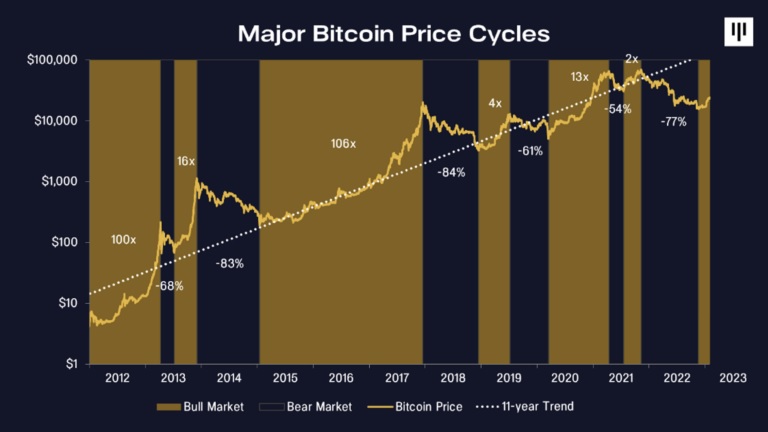

Renowned cryptocurrency funding agency Pantera Capital says that we are now in the next bull market cycle, with BTC’s lows and highs.

Pantera Capital Confirms They’re in a Bull Market

The corporation’s founder and managing partner, Dan Morehead, made the statement in the Pantera Capital Blockchain Letter released last week. Titled “The Seventh Bull Cycle,” the letter was written by Morehead, Partner Ryan Barney and Sehaj Singh. Pantera Capital is a funding agency that specializes in cryptocurrencies, digital assets, and blockchain technology.

Morehead referenced his assessment of bitcoin price cycles in his letter. He tweeted Thursday:

I believe that blockchain assets (which use Bitcoin as a proxy) are at their lowest point and that we’re in the bull market cycle. This is regardless of what happens within the rate-sensitive asset classes.

“That would be the seventh bullish cycle, after six bearish cycles,” he said. Morehead’s letter details that Pantera has been through 10 years of bitcoin cycles, and 35 years of similar cycles.

The famous founder noted that the BTC’s value dropped from November 2021 to November 2022, “the typical cycle median.” He added: “This is the only bear market that completely wipes out the previous bull market. In this case, giving back 136% of the previous rally.”

“The average decline has been 307 days and the previous bear market was 376. The average decline has been -73% and the last bear market ended at -77%,” Morehead continued. “I think we’re done with that and started moving higher.”

Morehead added:

In the long-term, bitcoin’s value has experienced a secular uptrend of 2.3% per year over the last twelve years.

Do you agree with Pantera Capital Founder Dan Morehead that we are already in a bull-market cycle? Let us know via the feedback page.